tax on forex trading ireland

USC is tax payable on an individuals total income. You can only deposit money from accounts that are in your.

Fx Taxation In Commonwealth Countries What To Know Avatrade

Tax paid in the foreign territory on the branchs trading profits should be available by way of a credit or deduction depending on whether it is governed by a double tax.

. Is forex trading tax free in Ireland. Seeking information about online Forex trading in Ireland. Tax On Forex Trading Ireland.

Forex futures and options are 1256 contracts and taxed using the 6040 rule with 60 of gains or losses treated as long-term capital gains and 40 as short-term. All trading and financial activities within Ireland are regulated by the Central Bank of Ireland. Instead you will be subject to corporation tax on.

The margin is the. And from short-term capital gains 35. Have you considered incorporating into a trading company.

EToro income will also be subject to Universal Social Charge USC. You should always seek advice from a tax accountant professional or the HMRC because tax law can be confusing and subject to. Tax on forex trading ireland plus500 automatic rollover.

If you trade CFD forex or spot you need to pay taxes of 10 if you earn less than 50000 or 20 for profits above 50000 the tax-free limit. We have reviewed over 900 online trading companies for Irish. Income Tax rates are currently 20 and 40.

Income Tax will arise on deposit interest earned on margin. Capital Gains Tax will arise on the difference between opening and closing values of an asset. Capital Gains Tax CGT.

Section 21 of the Taxes Consolidation Act 1997 TCA 1997 sets the general rate of corporation tax at 125. Through the forex trading futures the investors will be effectively taxed a maximum of 15 from their long-term capital gains. Is Trading Tax Free In Ireland.

Taxes on capital gains If you sell shares or any other property for a higher price than what you paid for it you will be taxed on your capital. Yes forex traders pay tax in the United Kingdom. By doing this you will only be subject to income tax once you pay yourself a wage.

That rate applies subject to certain exceptions set out in Section 21A to trading. Currency trading tax is advantageous in the current climate whether it is secondary income or your main source. Once mysterious and treated with scepticism cryptocurrencies are now becoming increasingly mainstream and a popular investment option for more and more Irish people.

Is Trading Tax Free In Ireland. An increase in the price of your property is regarded as an increase in capital gains if you sell it for more than you paid for it at the time. However irish residents are also free to.

There will rarely be a day when something is tax free. That is the profits from trading will be taxable under Income Tax rules. Understanding forex trading taxes.

IM Academy Forex Trading was started as a small startup in 2013 by independent entrepreneur Christopher Terry and Forex expert Isis De La. You put up a fraction of the capital and still get the full value of the. Get started now at the best Forex broker for Ireland.

5 rows Taxation on Forex Trading in Ireland All spread trading profits in Ireland is recognised. Therefore individuals that are trading in cryptocurrency are required to file an income tax return Form 11.

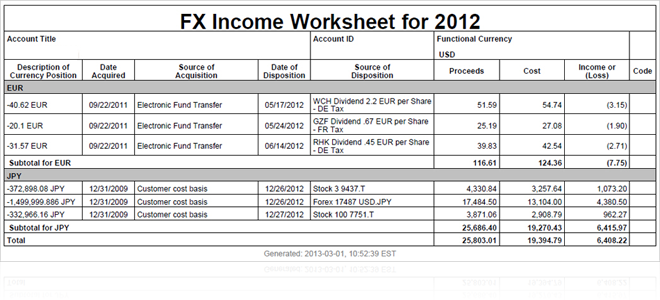

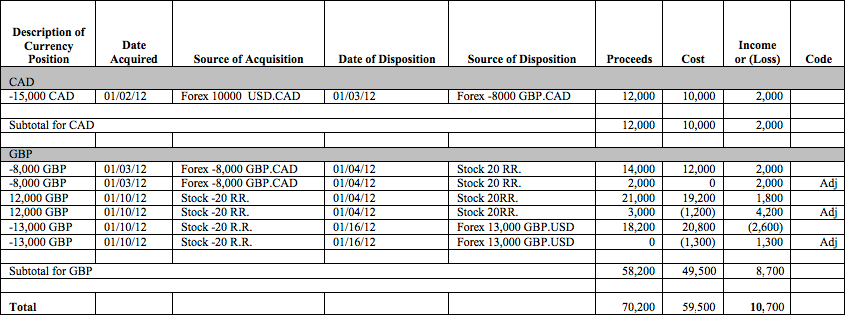

Tax Information And Reporting Fx P L Interactive Brokers Ireland

Forex Trading Online Forex Currency Trading Cmc Markets

Tax Information And Reporting Fx P L Interactive Brokers Ireland

2021 Capital Gains Tax Rates In Europe Tax Foundation

Spot Forex Vs Cfd Vs Spread Bets My Trading Skills

Is Currency Trading Tax Free The Lazy Trader

Online Currency Trading Platform

What Is Forex Trading And How Does It Work How To Trade With Ig Youtube

10 Best Forex Brokers For October 2022

Forex Tax Free Countries In 2022 Forex Education

Will The Global Minimum Tax End The Race To The Bottom Video

How To Trade Forex Turbo Warrants Ig Ireland

Diversify Your Income With Irish Reits Seeking Alpha

7 Best Forex Trading Books For Beginners In 2022

What Are The 10 Main Benefits Of Forex Trading

Crypto Tax Ireland Here S How Much You Ll Pay In 2022 Koinly

/smiling-businesswoman-in-discussion-with-clients-at-office-workstation-1097995910-840608b2994d4755a82ae3a234e4ed90.jpg)